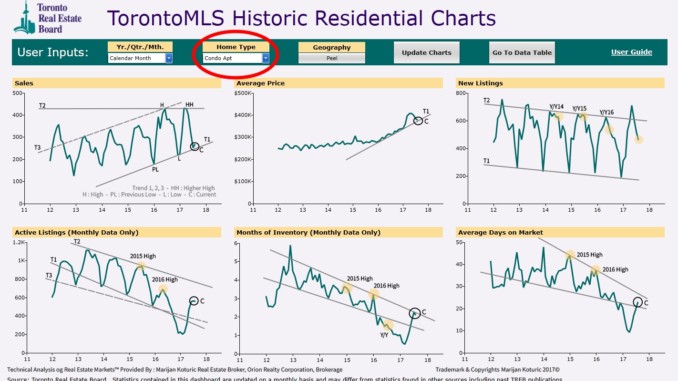

Condominium market in Peel region continues to defy the overall market trend, which cannot be said for the freehold property type.

As it stands, based on the most recent TREB data, Condominium Sales are within the range of the expected trend, albeit a bit too early, (the current level was expected a bit later in the year). This confirms that a large number of buyers are flocking to condominiums as the alternative to high priced freehold homes. The volume of the sales did not significantly exceed the previous year’s high and the downturn again coincides with Ontario government’s policy announcement, which derailed the real estate market in the Spring.

Interestingly, the Average Price of Condos in Peel region has managed to stay above the 2-year trend line which could possibly prove itself as a strong support for the price. This is very likely due to the fact that Condominiums remain the only semi affordable option for real estate in the market and exceptionally affordable when compared to the home prices even at their current levels.

New Listings levels, although slightly above the range after the government’s announcement, is now well within the expected range, suggesting that there is not an oversupply of new listings that would flood and devaluate the market further. This points further to condominium market’s strength.

Active Listings chart shows an increase in overall number of listings on the market, but at the same time it is below 2016 high and back in the expected range, once again suggesting a level of strength in the condo market.

Months of Inventory chart points that it is definitely taking longer to sell condominiums, and the supply levels are building up, in fact higher than the same period last year, but lower than 2016 high. What is encouraging for those worrying about their condo values dropping, is that the current levels have bounced back within the expected range and if they manage to stay below the upper boundary, the condominium market could maintain the more positive outlook and provide better value, (when compared to the freehold real estate).

Although it clearly takes longer to sell the condominiums then it did in the early 2017, the Average Days on Market is back within the expected range and well below 2016 levels.

Clearly, the Condominiums, even with their maintenance fees (which sometimes include some utility costs), are showing more market stability for the time being, (at least in the Peel region). It is my opinion that we will see this stability until either; the prices of condos rise (or freehold home prices fall further) until owning a condo vs. a freehold is no longer a price advantage, or Ontario government & Central Bank intervene with further lending policy tightening and/or rate increase (possibly in December).

If you are in the market and you need a real, proven, award winning expert, to help you buy or sell your home then call, text or message me to get started.

Marijan Koturic, Real Estate Broker

Orion Realty Corporation, Brokerage

647-892-5007

Disclaimer: Above charts are generated by Toronto Real Estate Board. The technical analysis provided above is for informational purposes only and it is not an investment or buy/sell advice and it is not indicative of future real estate market performance.